2024 was a successful year for the Swiss marketplace lending industry, with all segments reporting higher volumes than 2023 with clear signs of continued momentum, according to the 2025 Marketplace Lending Report by the Lucerne University of Applied Sciences and Arts (HSLU), and the Swiss Marketplace Lending Association (SMLA).

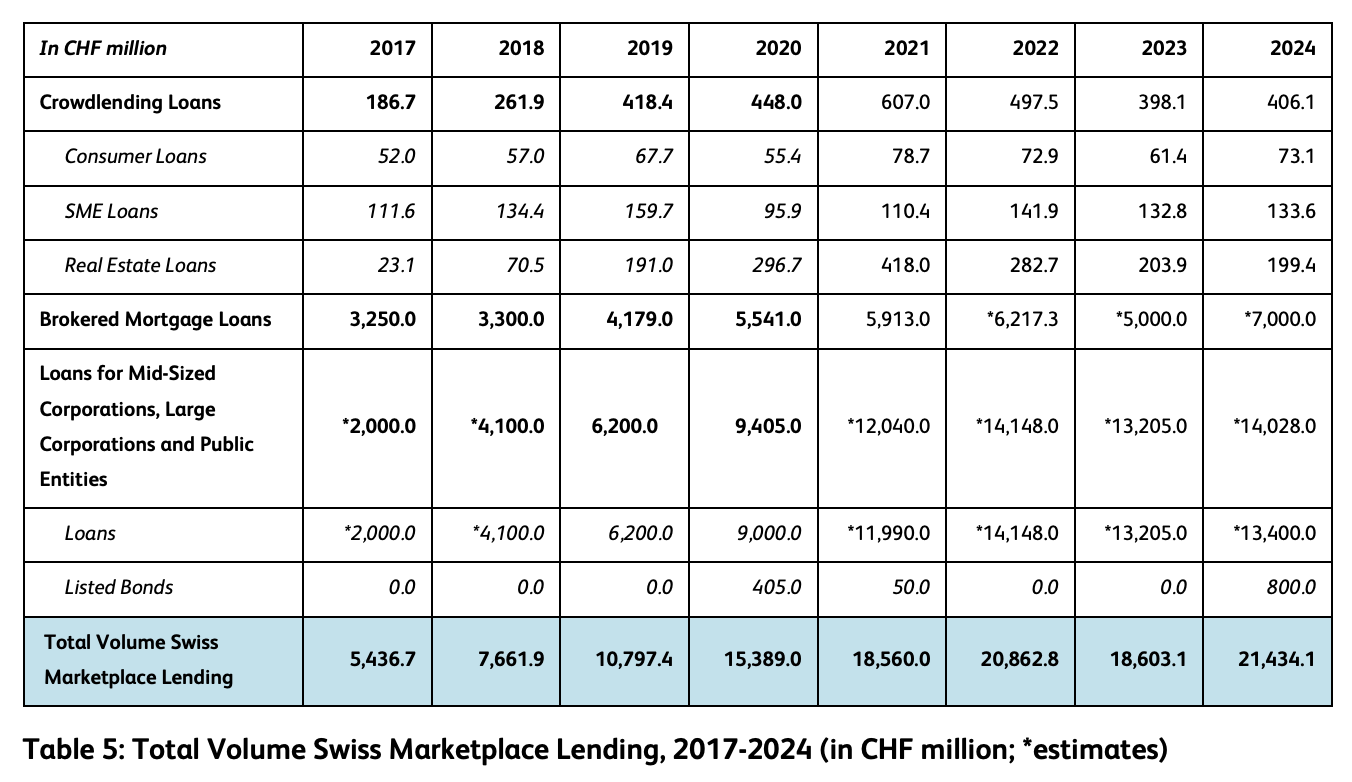

The total volume of new debt capital issued on online platforms in 2024 reached approximately CHF 21.4 billion, roughly four times the volume recorded in 2017 and representing an annual average growth rate of about 22%.

Among all segments, mortgage loans and loans to public entities and corporations were key drivers of this growth.

Mortgage lending leads growth

In 2024, the mortgage brokerage segment was a major growth engine for the Swiss marketplace lending industry. The segment expanded by an impressive 40% to reach a record volume of CHF 7 billion.

Switzerland’s mortgage brokerage segment is currently served by ten players, all targeting professional investors such as banks, insurance companies and pension funds. Two of the most prominent ones are bank-owned:

- UBS key4 mortgages is the result of the integration of Atrium into UBS’ key4 platform. The platform offers UBS’ own mortgages and mortgages from third parties.

- BrokerMarket, by Thurgauer Kantonalbank (TKB), operates as an intermediary connecting mortgage borrowers with lenders through mortgage brokers, using a business-to-business-to-consumer (B2B2C) model. Lenders join the platform free of charge and pay a closing commission only upon successful completion.

Other prominent marketplace lending platforms for mortgages include Credit Exchange, a cooperative venture between Mobiliar, Vaudoise, PostFinance, Swisscom, Bank Avera and Glarner Kantonalbank; and MoneyPark, Switzerland’s most established independent mortgage brokerage firm launched in 2012.

Others include Resolve, topHypo, feyn, SwissFEX, Hypohaus, and Hypo Advisors.

Marketplace lending currently accounts for about 4% of all mortgages brokered in Switzerland. Yet, according to a survey by the Institute of Financial Services Zug (IFZ), over a third of mortgage borrowers are open to arranging their mortgage through an intermediary in the future, pointing to significant growth potential for mortgage marketplace lending.

Loans to public entities and corporates rebound

Another highlight in 2024 was the strong performance in loans and bonds for public and near-public entities, and mid-sized and large corporations. After a slight decline in 2023, activity rebounded back to 2022 levels last year, with total volumes rising 6.2% year-over-year (YoY) to approximately CHF 14 billion.

This category targets entities such as municipalities, cities, cantons, and government-related corporations, as well as mid-sized and large corporations. Investors here are typically banks and institutional and professional investors, including asset managers, family offices, and pension funds.

Two platforms currently operate in this segment:

- Loanboox, active since 2016, offers loans to public entities, corporates, housing cooperatives, real estate funds, and companies. The platform charges a fee of one to two basis points per year, depending on country and segment, and is active in 12 European countries. Since its founding, Loanboox has transacted over CHF 30 billion across 3,500 transactions.

- Cosmofunding, owned by Bank Vontobel, focuses on public and corporate borrowers. Bank Vontobel generally assumes the role of a lead manager on behalf of investors, acts as the paying agent for private placements and bon issuances, and orchestrates the platform and various stakeholders. Projects are listed in an auction format for a specified period and, upon successful completion, are securitized. In 2024, traded volume on Cosmofunding achieved a YoY growth of 9.2% to reach CHF 11.9 billion, with total issuance since launch amounting to approximately CHF 46 billion in private placements, loans and bonds. The platform is now looking to expand internationally beyond the German, Austrian and Swiss (DACH) region.

With online financing becoming an established option for municipalities and cantons, and corporate loans and private platforms remaining in strong demand, HSLU and SMLA expect the segment to record further growth moving forward.

Positive outlook for the sector

Finally, crowdlending, which cover consumer loans, business loans, and mortgage-backed loans and are typically funded by a mix of private and institutional investors, also witnessed growth in 2024, with volumes rising 2% YoY to CHF 406.1 million. This marks a recovery from recent challenges, including COVID-19, economic uncertainties, inflation, and rising interest rates.

With Switzerland returning to a low-interest-rate investment, the outlook for crowdlending and the broader marketplace lending sector is positive as investors are expected to increasingly turn to these platforms for stable and higher yields, the report says.

In June 2025, the Swiss National Bank (SNB) cut rates by a further 25 basis points to 0%, a low-inflation environment which Switzerland has been accustomed to. A key factor behind this is the strength of the Swiss franc. As a well-known safe-haven currency, the Swiss franc tends to appreciate during periods of global market stress. This systematically pushes down the cost of imported goods and helps keep domestic inflation low.

However, persistent low rates also bring challenges. Savers see returns on their deposits eroded, while banks face pressure on their margins as loan returns decline.

Featured image: Edited by Fintech News Switzerland, based on image by thanyakij-12 via Freepik