Wealth Tax

The total value of your findependent investment solution is subject to wealth tax, just like all other movable assets (e.g., jewelry, cars, bank balances) and immovable assets (e.g., real estate). Exempt from wealth tax are pension fund assets, vested benefits accounts, and pillar 3a accounts.

In most cantons, there is a tax-free allowance or similar exemption for wealth tax. Wealth tax only applies once this threshold is exceeded.

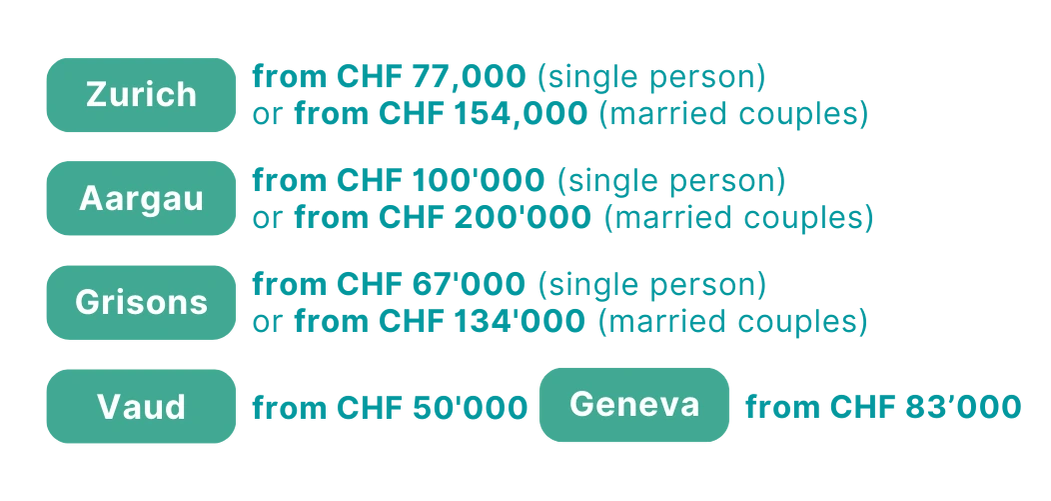

Here’s an overview for some cantons (as of May 2024). Wealth tax applies starting at the following asset levels:

This overview, of course, doesn’t indicate the actual tax amount. For that, you’d need to consult the canton’s tax rate or use their tax calculator.

According to the latest federal survey (2015), the median wealth for individuals aged 41 to 45 is CHF 72,000. Based on this, at least half of the Swiss population does not pay wealth tax.

Let’s take the example of a single, childless person with no religious affiliation, living in the main town of their canton, with CHF 200,000 in assets. Roughly speaking, the following annual wealth taxes apply:

| Canton | in CHF (ca.) | in % (ca.) |

| Zurich | 150.- | 0.07% |

| Aargau | 100.- | 0.05% |

| Grisons | 250.- | 0.12% |

| Geneva | 400.- | 0.20% |

| Vaud | 600.- | 0.30% |

Let’s assume the following:

You live in Aarau, are single, childless, and have no religious affiliation. Your total wealth is CHF 150’000. After deducting the exemption (Canton of Aargau: CHF 100’000), your taxable wealth is CHF 50’000. Of that, CHF 20’000 is invested in the findependent investment solution Balanced.

The CHF 20’000 in your findependent investment solution results in an annual tax burden of around CHF 20.

Important: This wealth tax applies to you either way. You’ll pay it, whether the money is sitting in a savings account or working for you in an investment solution.