Binod Kumar, MD & CEO, Indian Bank, at a press conference in Chennai on Thursday

| Photo Credit:

BIJOY GHOSH

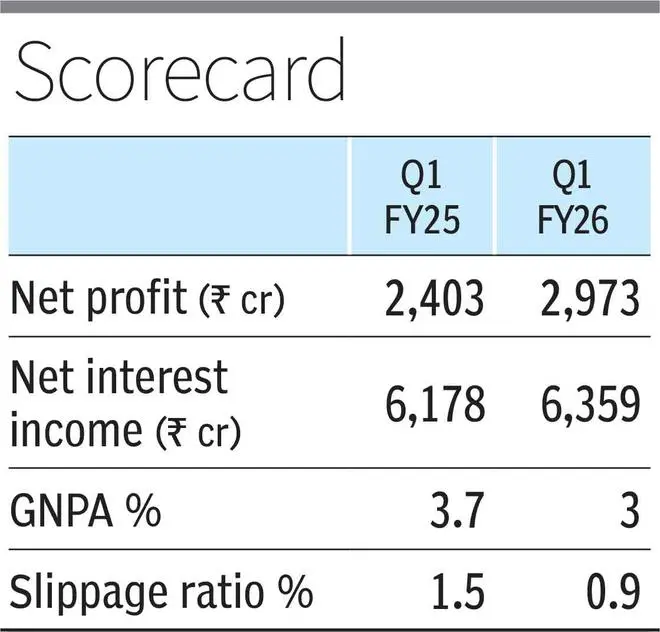

Indian Bank on Thursday reported a 24 per cent year-on-year (y-o-y) growth in net profit, at ₹2,973 crore, in the quarter that ended June, 2025 (Q1 FY26).

Net interest income (NII) increased by 2.9 per cent y-o-y to ₹6,359 crore in Q1 FY26, compared to ₹6,178 crore in the year-ago period. A 28 per cent uptick in non-interest income, comprising priority sector lending certificates (PSLCs) sales, forex income, and recoveries, also aided profit growth.

The quarter’s profitability was driven by increased lending under the retail, agriculture and MSME segments (RAM), with gross domestic RAM advances growing 16 per cent y-o-y in the quarter. RAM accounts for 65 per cent of gross advances, up from 62 per cent in Q1 FY25. Corporate lending, however, continues to be slow with just a 2 per cent y-o-y increase in corporate advances at ₹1,92,660 crore.

The bank’s total deposits increased by 9 per cent y-o-y to reach ₹7,44.289 crore in Q1 FY26.

Binod Kumar, MD & CEO, Indian Bank, said they have been able to curtail slippages both with improvement in credit underwriting and with the help of tools like their in-house predictor of bad loans that helps them take proactive steps. “We are on track to touch the ₹3,000-crore mark in net profit in the coming quarter,” he said.

Asset, digital banking

The public sector lender’s asset quality also showed improvement. Slippage ratio was down to 0.9 per cent in Q1 FY26 compared to 1.5 per cent in the year-ago period. Fresh slippages in the quarter came in at ₹1,334 crore – down 31 per cent y-o-y. Gross NPA percentage dipped from 3.7 per cent in Q1 FY25 to 3 per cent in Q1 FY26. Net NPA also declined 21 basis points (bps) to 0.18 per cent in the quarter.

In case of corporate lending, the MD said that they have reduced the exposure to NBFCs marginally and there have been large repayments in the quarter. “If you see sanctions, there has been an almost 50 per cent increase in new sanctions in the quarter; we are being conscious of the rates in lending to companies,” he added.

Indian Bank generated business of ₹57,955 crore through digital channels in Q1 FY26. The number of mobile banking users has grown by 15 per cent y-o-y, to touch 2.02 crore.

The shares of Indian Bank ended the trading day at ₹652.3, up 4.43 per cent on the BSE.

Published on July 24, 2025