Every investor understands the classic trade-off: higher rewards come with higher risks. But what if that isn’t entirely true?

What if there was a way to earn additional income from your portfolio without changing your investment strategy and taking on more risk?

The world’s largest asset managers — BlackRock, Vanguard, State Street — already figured it out. They don’t just hold assets, they put them to work. They lend them out and generate additional revenue. It’s called securities lending.

Some use it to beat the benchmark and boost returns. Others, like ETF issuers, leverage it to reduce costs for investors. Either way, they’ve found a way to maximize the value of their portfolios.

But these institutions couldn’t afford to take unnecessary risks with their clients’ assets. That’s why securities lending has been carefully designed and refined over decades — to generate additional income while maintaining portfolio security.

They did it by building in protections and safeguards:

- They choose who borrows their securities, ensuring they lend only to trusted, well-capitalized institutions.

- They demand “insurance”, known as collateral, worth more than the value of the lent securities — ensuring they are always fully covered.

- They remain in full control over their investments, with the option to sell their assets at any time (even when on loan), and they can even choose which assets to lend or exclude.

- They also retain beneficial ownership rights (except for voting), so they can continue earning dividend payments.

(Cash payments in lieu of dividends may not qualify for the same tax treatment as “qualified dividends.” Consult a tax expert for specific implications).

By designing it this way, securities lending became a core revenue stream for almost every asset management firm in the world. (9/10 of the world’s largest are doing it).

For years, this was an advantage only they could access. Swissquote has made it possible for every client to do the same. With a simple opt-in, you can lend your portfolio to top-tier banks, benefit from collateral protection, and decide exactly which securities to lend or not.

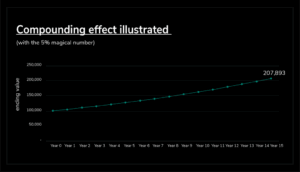

If you have a narrow portfolio view, the additional income might not seem like much — 0.3%, 1%, maybe 2%, or even more.

But investing isn’t just about today. When you take a long-term view, those extra returns mount up. This is the power of compounding.

A modest boost in returns each year, compounded over a decade, can create a significant difference in overall portfolio performance.

What’s more, certain high-demand securities can command much higher lending fees, offering surprising revenue opportunities.

Here’s an example:

In-demand securities and ETFs and their lending rates (%) — January 2025*

Yes, low-risk, high-reward opportunities exist.

And for Swissquote clients, the doors are open.

The securities presented above are based on lending data from 1 January to 31 January and are provided for informational purposes only. The lending rates displayed represent the ‘price’ borrowers are paying to borrow securities on the given date. This is quoted as a percentage (annually).