Amit Jhingran, MD & CEO, SBI Life Insurance

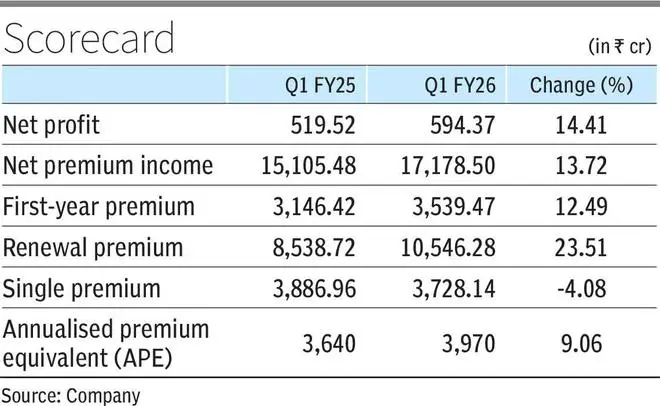

SBI Life Insurance on Thursday reported a 14.41 per cent year-on-year (y-o-y) increase in its net profit to ₹594.37 crore in the first quarter of this fiscal (FY26), backed by around 23 per cent y-o-y jump in renewal premium.

The life insurer had registered a net profit of ₹519.52 crore in the first quarter of FY25.

During Q1 FY26, net premium income grew 13.72 per cent y-o-y to ₹17,178.50 crore (₹15,105.48), according to a stock exchange filing. The first-year premium rose 12.49 per cent at ₹3,539.47 crore, whereas renewal premium increased 23.51 per cent to ₹10,546.28 crore for the period under review. Single premium, however, de-grew by 4.08 per cent y-o-y at ₹3,728.14 crore in the first quarter this fiscal.

The 13th-month persistency ratio rose to 87.12 per cent in Q1 FY26 (86.54 per cent). The 61st-month persistency ratio rose to 62.8 per cent (57.79 per cent), according to the filing. Solvency ratio during the quarter declined to 1.96 (2.01).

Expenses of management (EoM) rose 16.75 per cent y-o-y, to ₹1,915.17 crore, in the first quarter as against ₹1,640.36 crore in the year-ago period.

Resilience strategy

Annualised premium equivalent (APE) for Q1 FY26 grew 9 per cent to ₹3,970 crore, while value of new business (VNB) during the period rose 12 per cent at ₹1,090 crore. VNB margins improved 60 basis points (bps) to 27.4 per cent from 26.8 per cent in Q1 FY25.

Commenting on the results, SBI Life MD & CEO Amit Jhingran said in Q1 FY26, the insurer was able to achieve a favourable shift in its product mix towards protection solutions and guaranteed non-par savings, reflecting evolving customer preferences and the company’s strategic focus.

“The growth in renewal premium, along with improvement in our 13th- and 61st-month persistency ratios, reflects the strengthening of our customer relationships and the overall quality of our business,” Jhingran said.

Lead secured

The insurance company, in a statement, said it maintained its leadership position in individual rated premium of ₹3,470 crore with 22.3 per cent private market share in Q1 FY26. Growth in individual new business premium was 4 per cent, at ₹4,940 crore during the period.

During the earnings conference call, the MD said despite operating on a high base from the corresponding quarter last financial year, the company’s ability to maintain growth above the industry in the individual rated new business reaffirmed the resilience of its strategy. “Our agency and bancassurance channels continued to be the pillars of our distribution strength. Notably, in this quarter, other distribution partners like brokers and other bank partners also contributed meaningfully,” Jhingran said.

As on June 30, 2025, the company’s guaranteed non-savings products were contributing 19 per cent on individual APE basis. “Amid aggressive price trends across the industry, the company has remained disciplined, aligning its non-par savings product pricing with the market yield and has still achieved a steady and sustainable growth in this segment,” the MD said, adding the individual ULIP new business was at ₹2,740 crore and constituted 55 per cent of the individual new business.

Published on July 24, 2025