In 2025, scams continue to plague German consumers at alarming rates, and generate massive financial losses.

The State of Scams in Germany 2025 survey, carried out by the Global Anti-Scam Alliance (GASA) in partnership with BioCatch, polled 2,000 German people in March 2025 and found that 54% of German adults encountered at least one scam attempt in the last 12 months, with individuals facing an average of 163 scams approaches per year. This equates to roughly one scam encounter every two days, reflecting the high frequency and persistence of these threats.

Of those respondents, 46% actually fell for the scam, with 19% reporting to have lost money. On average, victims lost EUR 820 each in the past year. In total, the report estimates scam-related financial losses in Germany this year at EUR 10.6 billion, underscoring the severe financial toll of these threats.

Older generations are the most vulnerable, with the Silent Generation, born from 1928 to 1945, suffering the highest average losses, with scammers stealing an average EUR 4,022 per victim. By comparison, Baby Boomers, born from 1946 to 1964, lost an average of EUR 527.

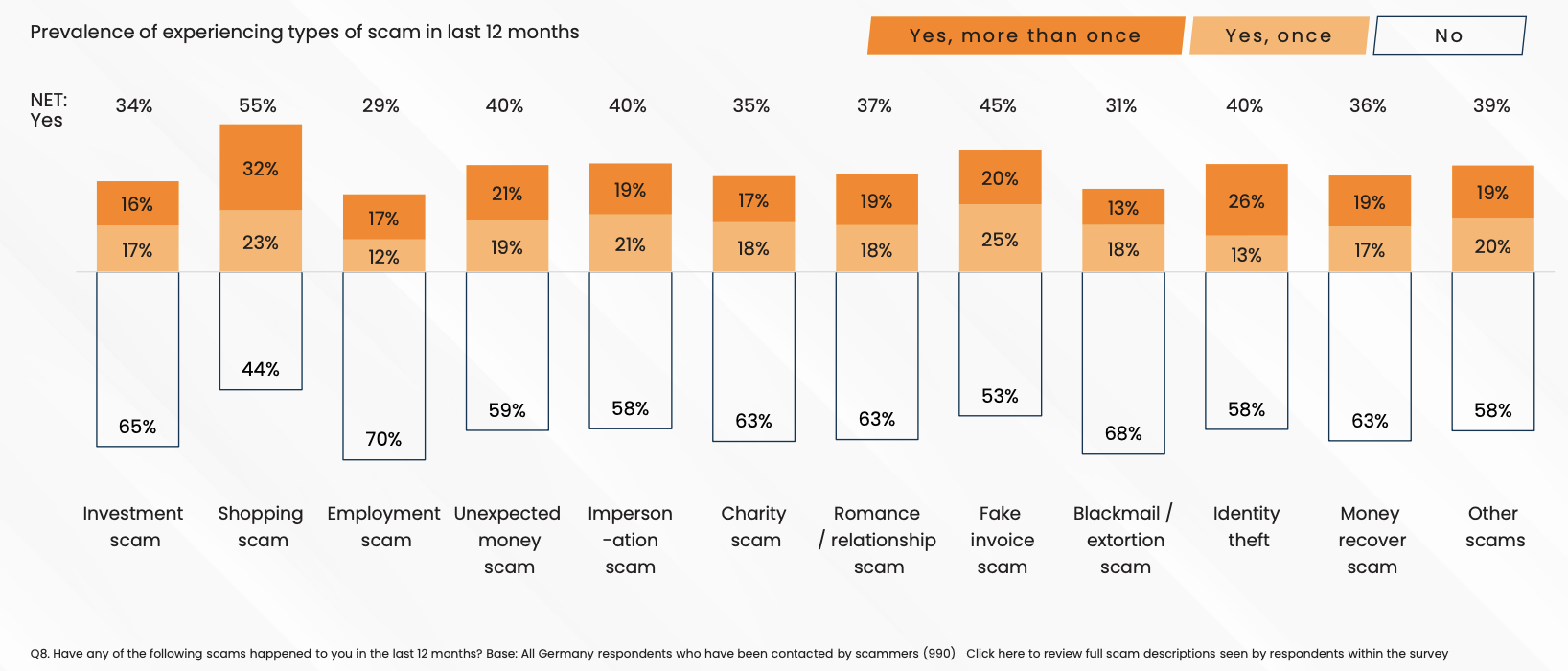

Shopping scams are the most prominent

Shopping scams are the most common scam type in Germany, affecting 55% of scam targets over the past year. This scam typically involves paying for a product or subscription that never arrives or turns out to be fraudulent.

Fake invoices are also widespread, affecting 45% of scam targets. In these cases, people are tricked into paying an invoice or a debt that is either fabricated or which does not belong to them.

Other prevalent scams in Germany include the unexpected money scam, the impersonation scam, and identity theft, each impacting 40% of scam targets.

The unexpected money scam typically tricks victims into paying money or giving personal or financial information to receive a prize, grant, inheritance, lottery winning, or sum of money that never materializes.

The impersonation scam involves fraudsters posing as government officials, bank employees, or reputable companies to extract money or information.

Finally, identity theft occurs when criminals misuse someone’s personal information without consent to transfer money, open loans, obtain documents, or make unauthorized purchases.

PayPal and bank transfers as top payment channels

In Germany, PayPal (31%) and wire bank transfers (21%) are the most common methods used to send money to scammers, underscoring the ongoing risks tied to widely popular payment methods.

Credit card payments come in third at 15%, followed by cryptocurrencies at 13%. Cryptocurrencies are an attractive channel for scammers because they allow fast, borderless, pseudonymous transactions that are harder to trace.

High reporting rates but poor recovery

Most victims in Germany do report scam incidents, but many see little to no resolution.

73% of scam-exposed Germans reported the incident. However, 58% said that either no action was taken (38%) or they weren’t sure what the outcome was (20%), highlighting serious gaps in remediation processes.

Similarly, the majority of victims report the theft to the payment platform (81%), only a minority are able to recover any funds (35%). 7% said the platform was able to block the payment before it reached the scammer, while 13% were able to recover all of the money despite it reaching the scammer. 14% said they were able to recover some of it despite the funds reaching the scammer. Alarmingly, 46% of respondents said they were not able to recover any money at all.

Gmail, WhatsApp, Instagram among most common scam platforms

Most of the scam encounters in Germany happen on platforms that have a direct message functionality, primarily email and text message. This highlights that scammers rely heavily on direct contact with individuals.

84% of scam attempts in Germany in the last 12 months occurred on platforms that have a direct message function, with the most prominent channels being emails (57%), text and SMS messages (45%), phone calls (45%), and social media (32%).

Specifically, WhatsApp (59%) and Gmail (33%) were the top platforms where scam encounters occurred. These platforms are followed by Instagram (27%), Facebook (27%), and TikTok (21%).

These platforms are prime communication channels for scammers because they offer easy, direct, and often private communication channels that make it simple to approach victims. Their massive user bases and frequent use for personal or financial conversations create opportunities for fraudsters to pose as trusted contacts or legitimate companies.

Scams have become a rampant and significant problem in Germany, with authorities struggling to keep up with these criminals. Just last month, a large-scale long-term fraud involving fake lottery winnings was dismantled, targeting German citizens and causing at least EUR 8 million in losses. The scam was run by a network of call centers that deceived victims into believing they had won lotteries or competitions, tricking them into making payments or subscribing to services under false pretenses.

In April, Istanbul police arrested 10 suspects in a massive operation after uncovering a transnational scam. The suspects, posing as police officers and prosecutors, defrauded 46 elderly German nationals out of about US$3.8 million.

In October last, year, German and Serbian authorities dismantled a large-scale online investment scam that defrauded victims of at least EUR 300 million through fake investment platforms. The scheme lured investors with promises of high returns but only returned minimal or no funds, while stealing personal and banking information to create fake accounts and boost credibility.

Featured image: Edited by Fintech News Switzerland, based on images by evrenkalinbacak and lemonsoup14 via Freepik