Turning to credit, our stance remains unchanged compared to our Q1 update. On the one hand, the prospects of continued economic growth (which we deem possible, but not certain) justify an exposure to lower credit (and higher yielding) companies. On the other hand, the valuations of the latter are very unattractive – the risk/reward profile is poor – and the second quarter worsened the situation. For this reason, we see more value in lower-yielding bonds offering higher quality (investment grade issues), both in the United States as well as overseas. An exception to the rule is represented by subordinated debt of financial institutions; as we noted in the past, the financial sector is very well capitalized, and most players have solid balance sheets, making their riskier issues very attractive, when compared to other segments of the market such as high yield or emerging markets bonds. It is indeed true that, in absolute terms, the current valuations of the entire asset class appear relatively unattractive. But so are most of the other asset classes, unsurprisingly.

EQUITY: NEW HIGHS IN THE MAKING

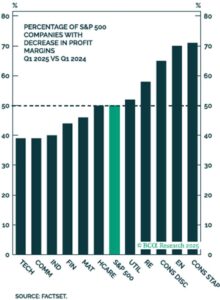

Quality, free cash flow production/margins and growth have been the performance driver since the market bottomed out in April ’25 and produced an extremely narrow US market, with 5 stocks contributing c. 80% of total return. It goes without saying that the  Magnificent seven remained a major contributor to earnings (EPS) growth although the contribution of the remaining 493 companies is rising. Forward guidance has improved compared to the previous quarter, but multiple companies have pulled out of submitting it, citing trade policy and economic uncertainty. The latter is weighing on earnings revisions for Q2, which has been falling steadily since the beginning of the year. Sectors mostly exposed to tariffs (energy, materials, industrials, and consumer discretionary) bear the brunt of the downgrades. As firms refrain from passing higher costs on to consumers, sector margins have come under pressure. Unsurprisingly, these sectors are cutting back on capital expenditure.

Magnificent seven remained a major contributor to earnings (EPS) growth although the contribution of the remaining 493 companies is rising. Forward guidance has improved compared to the previous quarter, but multiple companies have pulled out of submitting it, citing trade policy and economic uncertainty. The latter is weighing on earnings revisions for Q2, which has been falling steadily since the beginning of the year. Sectors mostly exposed to tariffs (energy, materials, industrials, and consumer discretionary) bear the brunt of the downgrades. As firms refrain from passing higher costs on to consumers, sector margins have come under pressure. Unsurprisingly, these sectors are cutting back on capital expenditure.

On the other hand, there is a lot of expectation built into the information technology and the communication services sectors. The top line growth has fallen, together with the free cash flow generating capability, as spending on artificial intelligence remains elevated. Yet, stock prices have soared on the back of a significant multiple expansion. Monetizing AI-related investments remains the major challenge for these firms but in the near-term, these two sectors will continue being the driver of EPS growth and margin expansion.

The current level of the S&P 500 Index (6,280) implies an 11% nominal EPS growth rate and a 1.5% real interest rate – both broadly in line with their long-term averages. However, these assumptions do not account for the possibility of a mild recession. Furthermore, they rely on the current valuation multiple (22× next twelve months’ earnings) remaining unchanged. In the short term, this is plausible, and as such, the equity market appears to be in equilibrium – neither particularly attractive nor clearly overvalued. Over the longer term, however, with valuations at these elevated levels, equity returns may struggle to significantly outperform those of a relatively unexciting Treasury bond.

Following the outperformance of European equity markets against their US counterparts, many commentators and many investors have begun calling for the end of the US hegemony. We agree that something may have changed on both sides of the Atlantic; there is certainly less confidence and more uncertainty in doing business with US firms, and there is clearly a willingness to spend more by European governments. However, Europe continues to be burdened by regulation, bureaucracy, and fragmentation, leading to productivity levels that lag significantly behind those of the United States.