The appointment calendar is overflowing, the waiting list for new customers is getting longer and longer. What initially sounds like a luxury problem quickly turns into a strategic challenge. Sooner or later, successful financial advisors are faced with the decision: should I continue to operate as a lone wolf or take the plunge and become a team-based company? This transformation promises sustainable growth, but also harbors considerable risks.

The most important facts at a glance

- Timing determines success: a liquidity reserve for six months of personnel costs is mandatory

- Strategic personnel planning: customer advice takes priority over support functions

- Industry-specific requirements: FINMA registration and certificates are mandatory

- Legal certainty: Pension fund obligation applies from an annual salary of CHF 22,680

- Management culture: the focus is on trust and personal responsibility

- Process optimization: systematically organize client handovers

- Realistic calculation: Plan for 15-20 percent additional costs above the gross salary

- Long-term perspective: return on investment only becomes apparent after 12-18 months

Setting the strategic course: Internal or external?

The decision as to which areas you fill with your own employees will have a significant impact on the future of your company. A golden rule applies here: team leadership begins where you have a direct influence on value creation.

Customer consulting is at the heart of every personnel development. This is where it is decided whether your growth is sustainable or only temporary. An experienced senior consultant can take on complex mandates immediately, while a junior consultant needs time and intensive support. Both models are justified, but require different management approaches.

Administrative support is an excellent introduction to team management. These areas relieve you immediately and allow you to concentrate on value-adding activities:

- Customer service assistance (60-80 percent): Appointment coordination, document management, follow-ups

- Junior financial advisor (full-time): Standard consultations under supervision, data analysis, product research

- Marketing support (part-time): Content creation, social media, event organization

Marketing and IT support can often be outsourced in the initial phase. Internal staffing only makes sense once the core team is in place and the processes are working.

Reading tip: Effective networking: how to secure long-term customer relationships

Timing is everything: when to take the plunge

Growth as a financial advisor requires more than just the desire to expand. The numbers have to be right before you transfer your first salary.

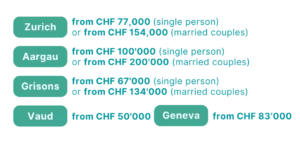

Minimum financial requirements:

- Monthly surplus of CHF 15,000 over six months

- Liquidity reserve for six months of personnel costs

- Stable customer relationships with recurring income

- Order pipeline for the next 12 months

However, a purely financial view falls short of the mark. Qualitative indicators are often more meaningful and speak a clear language:

Do you regularly work more than 50 hours per week? Do customers wait longer than two weeks for an appointment? Do you have to turn down lucrative orders because you don’t have the capacity?

It becomes particularly critical when administrative tasks take up more than 30 percent of your time. Then you have reached the point where you are working inefficiently as an entrepreneur. In such cases, the investment in an assistant usually pays for itself within a few months.

The search for the right people

Hiring employees in financial consulting means much more than just signing an employment contract. The financial sector has specific requirements that go beyond specialist qualifications. An IAF certificate or equivalent training is a matter of course. So is FINMA registration, if required.

The soft factors are often more decisive: does the candidate fit in with the corporate culture? Do they have the necessary social skills to advise clients? Can they work independently and function in a team at the same time? These questions determine the success or failure of the collaboration.

You rarely find the best candidates through traditional job advertisements. Industry networks such as the SFAA or the VQF are much more productive. Recommendations from business partners have proven their worth, as have targeted LinkedIn searches. Many successful financial advisors also use alumni networks from business schools.

A tried and tested approach is to work with specialized headhunters. They know the market and can identify suitable candidates who are not actively looking for a job. The investment of CHF 5,000 to 15,000 for a successful placement is well spent if you find the right employee.

Reading tip: The essential tools for the financial advisor

Avoid legal pitfalls

The legal framework in Switzerland is complex, but predictable. The pension fund becomes compulsory from an annual salary of CHF 22,680. You already reach this threshold with a 50 percent workload and a monthly salary of CHF 4,000. The insurance obligation begins on the first day of work, even during the probationary period.

You should expect social insurance costs of 11 to 13 percent of your gross salary. In addition, there are contributions to the pension fund and accident insurance. In total, additional costs of 15 to 20 percent above the gross salary are incurred.

Foreign employees without a permanent residence permit are subject to withholding tax. They must register with the tax authorities within eight days of taking up employment. Failure to do so can lead to severe fines.

As a financial service provider, you have additional reporting obligations to FINMA. New client advisors must be registered and their qualifications verified. The business organization must be updated accordingly. Compliance training for new employees is not only useful, but often mandatory.

Leadership in the financial sector: special features and challenges

Employee management differs fundamentally from other sectors. This is firstly due to the trust-based nature of the industry. Customers primarily trust people, not companies or brands. A new consultant must first earn this trust, which takes time and patience.

Responsibility for results is another factor. Financial advisors often work with variable remuneration models that require a clear target agreement. As a manager, you need to strike a balance between motivational pressure and realistic expectations.

A tried and tested model combines a fixed salary and profit-sharing. A basic salary of CHF 80,000 to 120,000 offers security, while a bonus of 10 to 30 percent creates additional motivation if targets are achieved. Alternatively, you can work with a profit-sharing scheme: A base salary of CHF 60,000 to 80,000 plus 5 to 15 percent commission on sales generated.

The target agreements should include both quantitative and qualitative aspects. New customer acquisition, sales per customer and customer satisfaction are measurable. Compliance, teamwork and the quality of customer relationships are just as important.

Reading tip: Financial advice for companies: The biggest challenges

Organization makes the difference

Team management requires systematic processes, especially when it comes to client portfolio management. One tried-and-tested method is customer segmentation: A customers with complex mandates remain with the senior advisor, B customers with standard products can be looked after by the junior advisor, C customers receive digital solutions or are referred to external partners.

Handover processes are critical for success. Detailed customer documentation in the CRM system is mandatory, joint introductory meetings create trust. Clear responsibilities and regular quality checks ensure service quality.

Your wealth of experience is the company’s most valuable asset. Scaling is only possible with structured knowledge transfer. Weekly case discussions have proven their worth, as have mentoring programs for new employees. Standardized consulting processes ensure uniform quality, and regular market assessments within the team keep everyone up to date.

Quality assurance starts with clear standards: Consulting documentation according to a uniform scheme, compliance checklists for all product categories and regular customer satisfaction measurements. Further training should not be left to chance, but should be systematically planned and implemented.

The calculation works: Cost calculation and expectation of success

Realistic budget planning is the foundation of any successful expansion. A junior consultant with a gross salary of CHF 85,000 will actually cost you around CHF 104,000 including all social security contributions. There are also one-off costs for recruitment (CHF 3,000 to 8,000), setting up the workplace (CHF 5,000 to 12,000) and training (CHF 5,000 to 15,000).

The additional running costs are often underestimated: office costs, training, insurance and expenses add up to a further CHF 5,000 to 10,000 per year. Overall, you should expect total costs of CHF 120,000 to 130,000 for a junior consultant.

The rule of thumb for amortization is: A new financial advisor should generate at least CHF 150,000 to 200,000 in sales after 12 to 18 months. This expectation is realistic, but requires professional training and continuous support.

Measuring success is part of the trade: monthly sales development, customer acquisition costs per advisor and customer retention rate after a change of advisor are important key figures. You should analyze the profitability per employee on a quarterly basis and take countermeasures if necessary.

Reading tip: Customer acquisition for financial advisors: How to win new customers

The path to entrepreneurial freedom

Building a team in financial consulting is more than just an expansion of business activities. It is the transition from independent consultant to entrepreneur. This transformation requires new skills: Instead of advising clients, you coach advisors. Instead of developing individual solutions, you create systems and processes.

The growth strategy also involves relinquishing control and investing trust. Many successful lone fighters find this difficult. But only those who dare to take this step can really scale their company.

The reward for these efforts is real entrepreneurial freedom. A professional team that functions without your permanent presence creates space for strategic decisions and new business areas. This is how you transform a successful consulting practice into a sustainable business.